Investing in DC / Maryland / VA

Location, location, location: how to choose an investment area.

why invest in the DC, Maryland area ?

The Maryland / DC / Virginia area is excellent for investment property: DC is the political, diplomatic and military center of the USA. This generates a strong need of rental properties for qualified tenants. Often a business / army transfer in this area is for two years: the perfect length for a lease from the owner point of view!

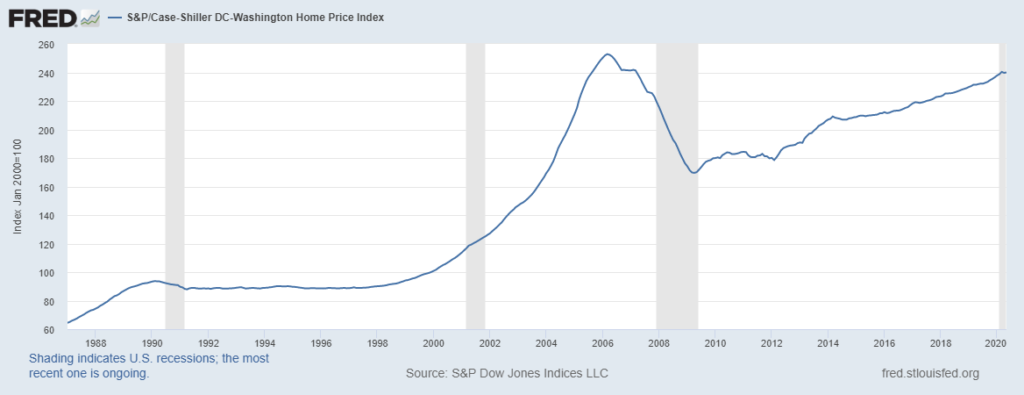

The DC area has a great advantage compared to the rest of the country: low volatility! Normally volatility is associated to financial markets abut real estate is just one of them. If you think for example of Detroit: Detroit had several financial crises due to the crisis in the auto industry. Somehow the DC area is more protected: The government will always give a basic level of income to the area.

Now lets check some stats here:

https://www.civicdashboards.com and look for vacancy by city in Maryland (or in the State you plan to buy )

Like everything in life, there are trades off with each choice. A very high Cap Rate might be a reflection that the area is not so safe to invest in. For instance, there may be more renters than owner occupants. Baltimore, for example, gives in general high Cap Rate, but investments in some areas bring a higher risk than those in, let us say, Bethesda. Baltimore however could offer a better appreciation rate than Bethesda, that is for the buyer to judge. If I had to put this in Stock market view I would say that Bethesda offers less volatility but also less returns on the investment, Baltimore offers highest return but also highest volatility: another riot in Baltimore could bring down the Real Estate Market easily a riot in Bethesda is more difficult to imagine…. well it was difficult to imagine since it just happened with the Black Life Matter protests. But I wanted to include this to show how unforeseen circumstances can actually happen.

After the Real Estate crash of 2008 any of the area that lost value was a good investment since it is a little bit like for buying stocks: you want to buy after the crash when the price is at the bottom as long as you have good feeling on the recovery of the area:

You can receive a lot of help just looking at the following graphs, you should use the graphs below but also use your own judgement, you should go to the area, walk around the area and build up your impressions.

https://www.zillow.com/rockville-md/home-values/

https://www.zillow.com/baltimore-city-md/home-values/

but also look at this

https://www.trulia.com/real_estate/Baltimore-Maryland/market-trends/

Same area, Same data source ( MLS) different views on the Market

https://www.zillow.com/hyattsville-md/home-values/

https://www.zillow.com/bowie-md/home-values/

https://www.trulia.com/real_estate/New_York-New_York/

https://www.trulia.com/real_estate/Gaithersburg-Maryland/market-trends/

Look at Demographic Trends, Drive the area

Another Source

https://fred.stlouisfed.org/series/WDXRSA

https://fred.stlouisfed.org/series/WDXRSA

STEP 10) We keep track of the return of this property and see if and when we can repeat the process

- Resources - February 29, 2024

- Funding Resourses for Real Estate - February 28, 2024

- Off Market Maryland properties - February 28, 2024